In software, a two-week sprint can change everything. In hardware, those same two weeks barely get you through supplier negotiations. Investors who apply a “software mindset” to hardware companies often underestimate one of the biggest risks: time-to-market. And in this game, speed isn’t just about being first; it’s about survival.

Hardware Is a Different Species

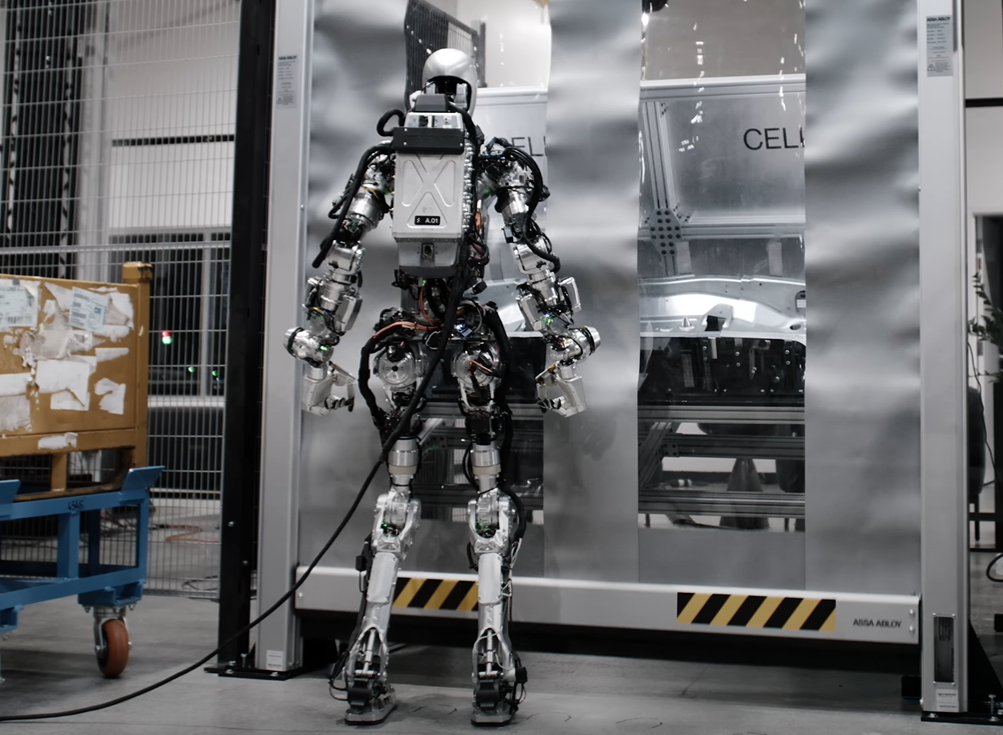

Unlike software, where iteration is fast and relatively cheap, hardware demands a sequence of slow, capital-intensive steps:

Each of these stages can take months and they are filled with mini pivots, lots of customers interactions and disappointments. A small misstep early can ripple into quarters of delay. As TechCrunch points out, hardware companies often “take years to iterate and scale compared to weeks or months in software,” which can test investor patience [TechCrunch].

Why Time-to-Market Matters to Investors

- Capital Efficiency: Extended cycles mean startups burn more cash than predicted before revenue comes in. CB Insights found that one of the top reasons why hardware startups fail is simply “running out of cash,” often caused by underestimating how long development takes [CB Insights].

- Competitive Risk: As Peter Thiel argued, being the last mover with a defensible moat is powerful. But in hardware, you rarely get to build that moat unless you survive long enough to launch [Thiel, Zero to One].

- Exit Timing: VC returns are tied to fund performance windows. As Mahendra Ramsinghani explains, a hardware company that slips by three years can distort a fund’s return expectations and jeopardize LP confidence [Ramsinghani, The Business of Venture Capital].

Managing the Hardware Clock

Great founders anticipate the drag of physical product cycles and adopt strategies to mitigate it:

- Parallelize work streams: testing and design should overlap where possible.

- Validate early willingness-to-pay: Madhavan Ramanujam stresses that pricing validation should happen before investing in expensive builds, since “pricing mistakes are the silent killer of products” [Ramanujam, Monetizing Innovation]. It is all about price-value and its understanding is crucial.

- Design for manufacturability: cutting months off setup time can mean millions saved.

- Investor alignment: savvy founders set realistic timelines and milestones, ensuring expectations don’t drift into software-like speed fantasies.

Investors who fail to factor in hardware’s time-to-market realities risk backing companies that never ship, or that run out of money just before the inflection point. For founders, the challenge is to show that you understand the hardware clock and have a plan to keep it from killing your momentum.