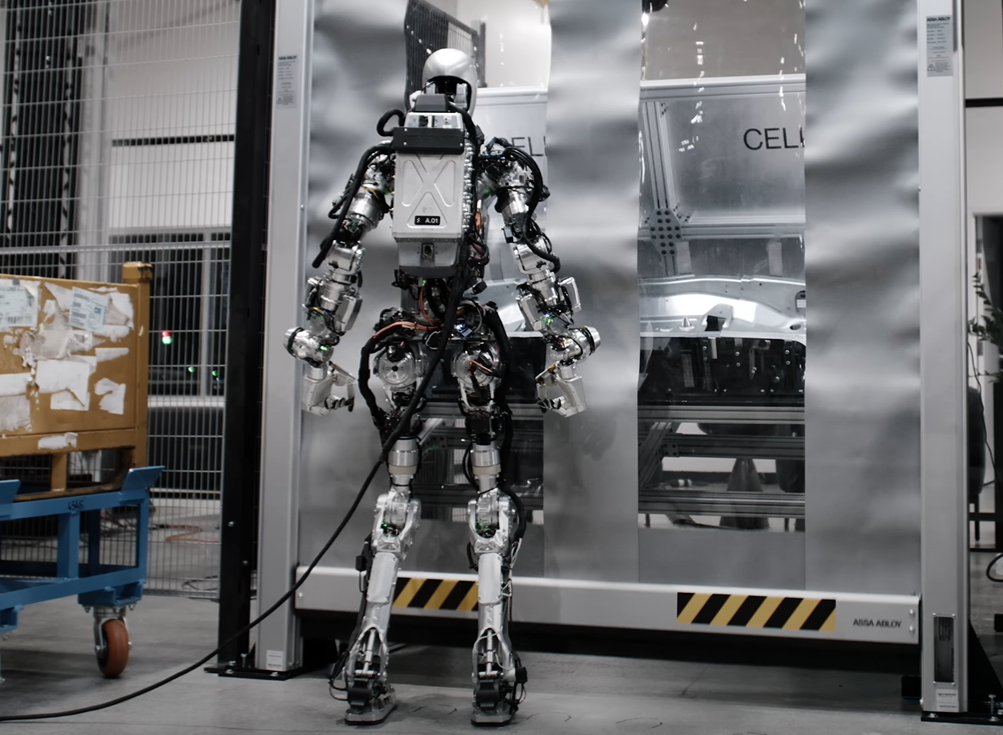

For investors already tracking the robotics and industrial automation space, 2025 may be validating what was long been predicted: robots are no longer a “next-gen” concept, they are an operational imperative across sectors, economies, and capital markets.

What changed? Not the existence of automation or smart machines, but the convergence of geopolitical will, technical readiness, and institutional capital pushing robotics into the heart of macroeconomic strategy.

Structural Shifts Backed by Policy and Capital

The UK’s £2.8B commitment to robotics R&D in factory innovation funding is a case in point. Similar tailwinds are emerging from U.S. and South Korean industrial strategies, each explicitly framing robotics as a lever for reshoring, defense resilience, and productivity reacceleration (techuk.org).

In July-25 alone, robotics investments globally topped $4.35B across 93 rounds, indicating that institutional LPs are no longer dabbling but committing (therobotreport.com).

What is Driving Allocator Behavior?

- Tangible ROI: Deployments across food, logistics, inspection, and pharma are proving unit economics. Companies like Chef Robotics or Gecko Robotics are turning cost centers into data-rich productivity engines.

- Hardware-Software Stack Convergence: Robotics firms (whether in food preparation or defense) are increasingly defined by software IP, not just motion systems. Thus, traditional hardware firms are closer to SaaS multiples when embedded data flywheels are visible.

- Non-dilutive and strategic capital: Public funding is no longer just for R&D, it’s becoming a demand generator via procurement. The Chips Act, Infrastructure Act, and sector-specific state incentives are now part of the cap table calculus.

- China risk and diversification: Decoupling is real. Manufacturers are pivoting to Malaysia, Vietnam, India, and U.S. reshoring, reshaping not just supply chains but VC-eligible ecosystems.

Strategic Exposure Framework: Where to Lean In

For sophisticated investors, opportunity lies in:

- Vertical-specific integrators: High-friction environments like food assembly, infrastructure inspection, or biopharma are ripening for robotic solutions with short time-to-value and non-zero defensibility.

- Tooling and component leaders: Motion planning, sensor fusion, and advanced grippers remain fragmented. Investors can arbitrage technical moats that incumbents undervalue.

- Foundry-model robotics firms: Like Nvidia in chips, some firms are becoming horizontal enablers—providing APIs, platforms, or physical systems to category-specific operators.

- Deployment infrastructure: Before robots can be used effectively at scale, they need a solid operational foundation, this includes physical installation, systems to manage fleets of robots, user interfaces that allow humans to guide or monitor them, and reliable support and maintenance services. These elements are still in early stages of development, but they’re critical. Without them, even the best robots can’t function consistently in real-world settings. Think of it like DevOps in software: it’s not the product itself, but the behind-the-scenes systems that make large-scale deployment possible.

Caveats for Capital Allocators

Not all tailwinds are equally monetizable:

- Fragmented go-to-market: Robotics is still highly verticalized, which demands domain expertise in each sub-sector, something many investors with generalist mindset underestimate.

- SME barriers: Despite price declines, full-stack robotics deployments remain capital intensive for mid-market operators. ROIs must be validated, and not only hypothetical.

- Workforce constraints: Technician retraining and mechatronic management are real bottlenecks. Human-robot interaction is not a UX problem; it’s an org-design and labor economics issue.

Robots for 2025/26 are less about moonshots and more about precise and fast deployment. The winning investments will likely come from funds and LPs that can triangulate macro tailwinds, technical specificity and capital stack orchestration.