But here’s the bright side: capital intensity, when approached strategically, is not just a challenge; it can be an advantage and even a differentiator. A moat as Warren Buffet would put it.

Turning Capital Needs into Strengths

- Proof of Seriousness

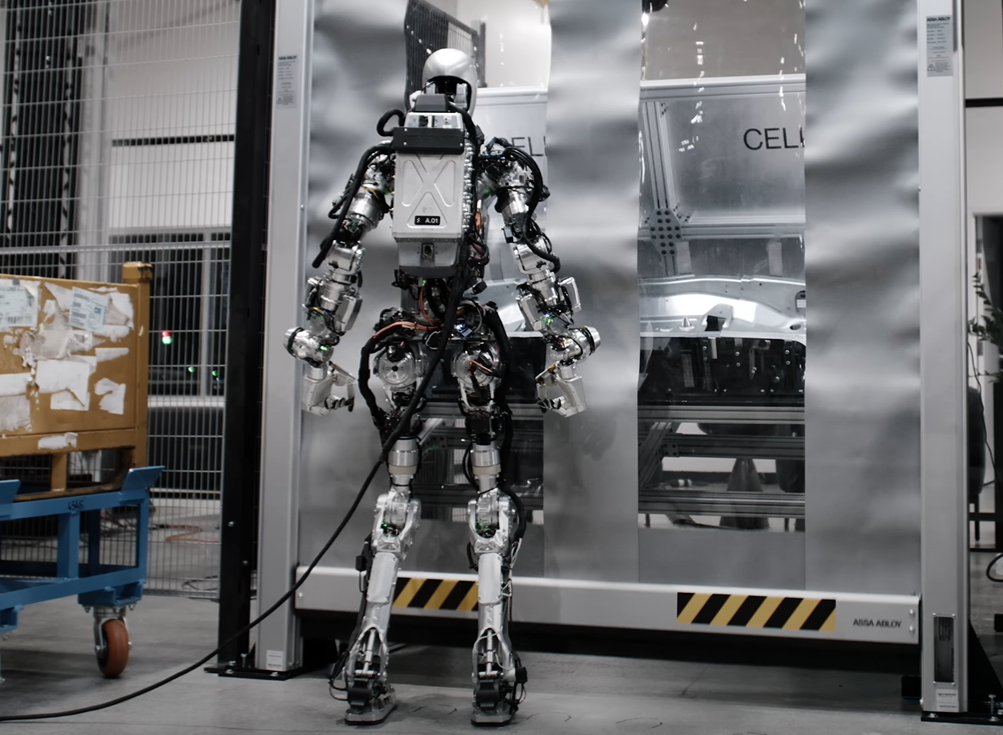

High upfront investment filters for founders with deep conviction. As Peter Thiel noted, great companies don’t emerge from lottery tickets but from deliberate commitment to creating something. Hardware founders who invest early demonstrate they’re not chasing quick wins but building durable value. - Barriers to Entry

Unlike software plays that can be replicated overnight, hardware requires real assets, tooling, and expertise. Clayton Christensen’s The Innovator’s Dilemma shows that industries with higher resource commitments create natural defenses against copycats because disruption requires patient capital and capability building [The Innovator’s Dilemma, Clayton Christensen]. - Investor Alignment

Early cash needs often intimidate investors, yet they bring clarity. When resources are tied to clear, measurable milestones, progress becomes transparent and builds confidence. Hardware startups can leverage this by breaking down capital deployment into milestone-driven sprints. - Customer Confidence

Robotics and automation customers buy reliability, not promises. Early investment in robust prototyping and tooling signals quality. Disciplined capital allocation builds trust not just with investors but also with customers who see tangible proof of durability.

Capital intensity can be a signal of durability, defensibility, and seriousness. For investors, the opportunity lies in backing teams who don’t just burn cash but convert it into long-term competitive advantage.