Global Robotics Growth: It Can’t Be Software Alone

No matter whose predictions you consult—Nasdaq’s, Goldman Sachs’, Morgan Stanley’s, or others—they all agree on one thing: aggressive growth in robotics. Today, startups in software, AI, and deep tech are far more common than hardware companies. The reason is simple: a software company can be created by one person with a laptop. Progress is fast, and the C-suite doesn’t need to understand the entire code to grasp its functions. However, software alone can’t perform tasks in the physical world, it needs hardware. If robotics trends are real, hardware will need to scale alongside software and AI.

Robotics as envisioned for the future requires complex systems that haven’t yet been produced at scale. These systems demand high levels of integration and standardization.

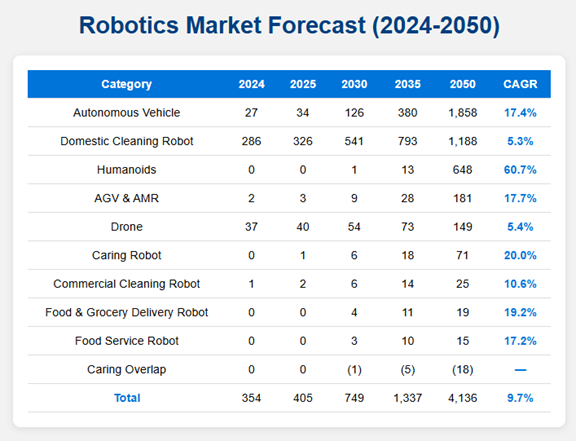

Table 1; Robot Unit Number (Millons), Forecast by Type. Source: CitiGPS

Physical AI fuses perception, physics simulation, and actuation, letting robots, vehicles, and smart spaces train in virtual worlds before acting safely in ours. NVIDIA’s Omniverse-based Cosmos and Isaac Sim now release open “world foundation models,” condensing millions of simulated hours into policies that jump to hardware. This pivot from digital-only to physics-aware AI should speed autonomous-machine rollout suggesting that there will likely be 1.3bn AI-robots by 2035 and 4bn by 2050. (CItiGPS)

What Type of Hardware? Only Humanoids?

Depending on the perspective and use case, projections for humanoid robots can be far more generous than for other types of robotics. This is driven in part by aging populations in developed countries and smarter automation. Some optimistic projections foresee robots in many households within five years. If so, robotic development will likely focus on multi-purpose home robots.

More conservative forecasts suggest general-purpose robots will be adopted primarily in industrial applications (B2B). These robots will also compete with application-specific robots that are cheaper, faster, and easier to maintain.

How Much of the Global Race Is Shaped by China’s Lead?

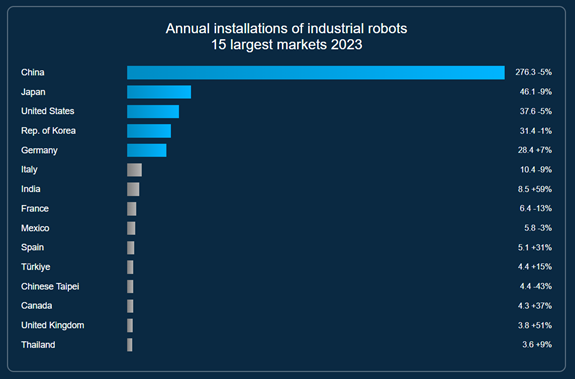

It’s true that many of the companies making rapid progress in hardware originate in China. Investing in Chinese hardware continues to be a sound strategy. However, regulatory environments differ, certification in the U.S. and Europe is more rigorous. Certifying multi-purpose humanoid robots is particularly challenging. If certification occurs at the component level, it could help level the pricing field between Chinese and Western components, ultimately making the market more regulated and balanced.

In 2023, China installed 276,300 industrial robots, representing 51% of all global installations (IFR). Despite a slight 5% decrease compared to the previous year, China remained by far the largest market, surpassing the combined total of several major economies.

Chart 1. Expressed in thousands of units. Source: World Robotics 2024 (IFR).

USA: Traditionally Ahead, Now Behind?

Regardless of certification, most recent hardware breakthroughs have not originated in the U.S. Historically, the U.S. has led in cutting-edge technologies—examples include MIT’s Cheetah robot and advanced robotic hands. However, when it comes to market exposure and scalability, China currently leads. This leadership is supported by strong government backing and strategic national priorities. According to Reuters, state procurement for humanoid robots jumped from ¥4.7 million in 2023 to ¥214 million in 2024, letting firms like Unitree price full biped models near US $12 k. Beijing is creating a fund of one trillion yuan ($137 billion) to support startups in fields such as AI and robotics, according to official announcements. [Reuters]

The Rise and Fall of Cobots: Cognitive Robotics

Investing in hardware has often been a risky proposition, as seen in markets like UAVs, which largely remained confined to defense applications. A similar trend has emerged in collaborative robots (cobots). Leaders like Universal Robots and Fanuc have seen slowing growth. The primary reason is that cobots are generally slower than human workers and require complex integrations.

Chart 2. Expressed in thousands of units. Source: World Robotics 2024 (IFR).

While traditional robot installations steadily increased, collaborative robots peaked in 2022 and saw a 2% decline in 2023 — the first recorded drop.

AI and cognitive robotics offer hope for overcoming these limitations. Whether success will favor humanoid-like robots or application-specific designs remains to be seen—Boston Dynamics’ Stretch robot is one promising example.

Humanoids, Hands, Dogs, and More—What Will Prevail?

Humanoids dominate headlines, but they aren’t the only players. Quadrupeds like MIT’s Cheetah have inspired many designs, including robots for last-mile delivery and hybrid forms that combine biped and quadruped configurations.

It’s unlikely that this momentum will fade. While it’s too early to predict a single dominant design multiple vendors already have factory footprints and signed purchase agreements that, collectively, point to tens of thousands of legged robots entering service before 2030—making coexistence, not a single “winner,” the most plausible outcome.

The New Smartphone? Or a B2B Tool?

Some founders compare humanoids to smartphones, predicting they’ll transform human lifestyles. This analogy is debatable: smartphones had low barriers to entry, while robots face higher hurdles. An illustrative challenge is the deployment of robots in last-mile delivery scenarios, where field experience reveals significant delinquency risks, including vandalism and theft of parcels or entire units.

Pricing remains a major factor. Consider robot lawn mowers—while they address a real need, adoption remains limited due to cost mainly, among other things.

Will Humanoids Walk Among Us by 2030?

Projections suggest they will, but the reality is more complex. Regulations aren’t yet in place and could take time to develop—and potentially slow adoption.

Public safety concerns also play a role, especially with the viral nature of social media. B2B markets may offer a faster path: labor shortages and the potential for safer, more efficient operations could drive adoption.

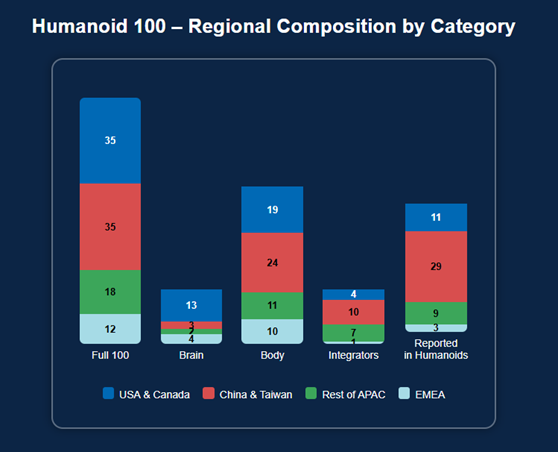

Investing in Components

A product’s success depends not just on price and performance, but also on availability. Robots require numerous specialized components: motors, encoders, drives, gearboxes, brakes, sensors, and more.

It’s challenging for robot manufacturers to produce all these components themselves. Focusing on core competencies and sourcing components strategically is crucial for scalability.

Components from China: Risks and Rewards

Sourcing key components from China can mitigate risk and improve availability and cost. Chinese robot manufacturers commonly use domestic components, while international companies also benefit from this approach.

However, challenges remain—cultural, logistical, and technical. The move toward Physical AI requires tight integration between component manufacturers and robot developers. This is why some companies pursue in-house component development despite the difficulties.

Chart 3. Companies reported to be working on humanoids Source: Morgan Stanley Research, Humanoids.

Final Thoughts

Robotics is an exciting frontier for hardware innovation. The projections are bold—and while no one is placing million-unit orders yet, careful investment in hardware will likely pay off.

Robots are coming. The question is not if, but when and in what form.