Scaling a hardware startup is a high-stakes balancing act. Move too early, and you risk collapsing under the weight of overhead. Move too late, and you may miss your market window.

What does “scale up” mean? How do I know I need to scale?

From scaling up by Verne Harnish In Verne Harnish’s framework, scaling up refers to the process of growing a company in a sustainable, strategic, and systemized way, not just growing revenue, but expanding capacity, leadership, culture, systems, and infrastructure to support rapid and enduring growth.

“Scaling up is not about growing for growth’s sake — it’s about building an organization that can handle growth efficiently and profitably.”

— Verne Harnish, Scaling Up

In other words, it’s about creating a repeatable, disciplined execution model so that growth doesn’t cause chaos.

If the business is made based on chaos, scaling up that would mean making a bigger chaos.

So the right moment to scale up is the moment, when that execution model has been found, and there is enough proof that it will work in a bigger scale. This is achievable by defining key metrics before hand of how those signs look like and measuring them in a disciplined way, e..g. Revenue on customers, new customers, and new leads as well as execution (deliveries and project closures). This article analyzes the metrics in a bit more detail.

OEM vs. Robotic Systems vs. Turnkey Solutions

There are distinct scaling strategies for different types of hardware companies:

OEM (Original Equipment Manufacturer): In OEM businesses, an early sale consists of low-volume prototype units, often generating small revenues. Success depends on achieving design wins with five to ten customers before scaling. Such number will depend on the size of the market, the bigger the market (beach head) the more customers are required before deciding to scale up.

Robotic Systems: These often sell in more substantial volumes initially, making organic growth through early profitability more feasible. Scaling should be based on successful deployment across several customers and projects, making it tougher to decide on when exactly.

Turnkey Automation Systems: These involve high costs and long sales cycles, sometimes up to five years. Startups should maintain auxiliary revenue streams like consultancy to bridge financial gaps and scale only once repeatable sales and successful deliveries are established. The most challenging type of business to scale.

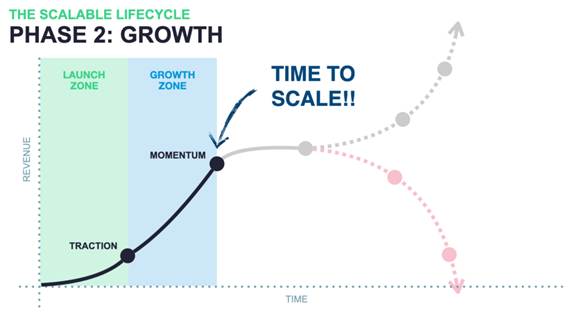

Figure 1: Momentum is the tipping point: where traction turns into exponential growth or fades into stagnation. Scaling at the right time determines the path forward. Source: Scalable.com.

Market Selection Strategy

Choosing the right beach head market is as important as the product itself. Target markets should:

-

- Be small enough to dominate early, enabling you to become a leader.

-

- Avoid trends with high volatility and unproven returns (e.g., 3D printers, UAVs, Humanoids, Quadrupeds, etc.).

-

- Expand into additional verticals only once profitability and product-market fit are secured.

Product adaptability also matters—modular robotic components offer more market flexibility than custom turnkey machines, reducing the risk tied to individual market shifts.

When Are You Ready to Scale – The metrics

In OEM Businesses, scaling aggressively should only happen after securing 5–10 design-in customer wins, provided the market is small enough. Adding a few engineers or salespeople gradually is acceptable; premature expansion is not.

For robotic systems, indicators include having sold 50+ units across multiple customers. In turnkey systems, indicators include completing multiple successful sales cycles and delivering on customer outcomes.

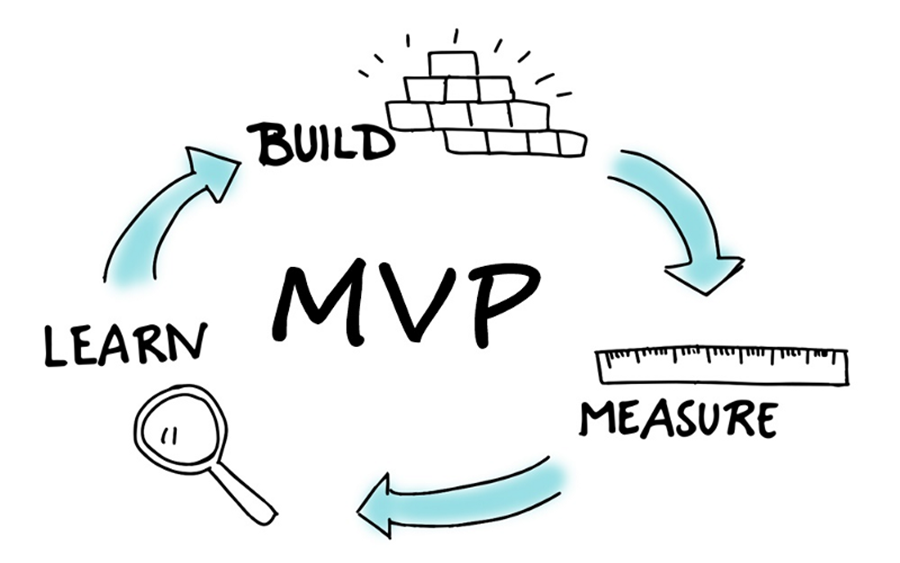

The reason for securing early adopters is that the product-market fit needs to be tuned, and this is only possible with the corresponding feedback from customers.

Figure 2: Start small, learn fast. The Build–Measure–Learn loop is the engine behind every successful MVP and a safeguard against scaling too soon. Source: The Lean Startup

Metrics That Matter

To validate readiness without hitting a hard sales number, track these:

-

- Shortening sales cycles.

-

- Faster customer feedback loops.

-

- Indicators of product maturity and repeatability.

These metrics can help mitigate risk while positioning for scale.

Conclusion

Most Start ups fail. Unpredictable future and failure on management on a just do it approach is the main reason, but also even when things go well at the beginning, scaling up prematurely is another reason for companies to fail. Taking time to validate the product , the market and the product-market fit, reaching profitability where possible, and avoiding premature overhead expansion is a difficult but possible strategy. Reference frameworks such as the Scaling up and Crossing the chasm can help guide thedecision-making process.